Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

“No One Can Tell What’s Ahead” – Brazil Tumbles Into Bear Market Amid Latest Economic Crisis

Brazilian markets and the Brazilian real both extended their recent declines, with the former sliding into a bear market, as investors around the world reacted to Brazilian President Jair Bolsonaro’s push to ramp up government spending to a degree that would violate fiscal constraints.

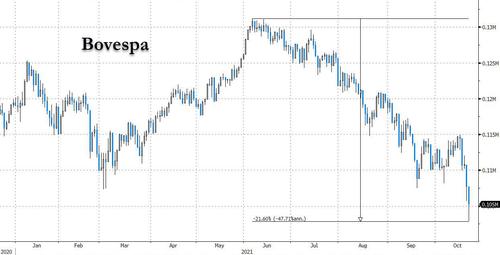

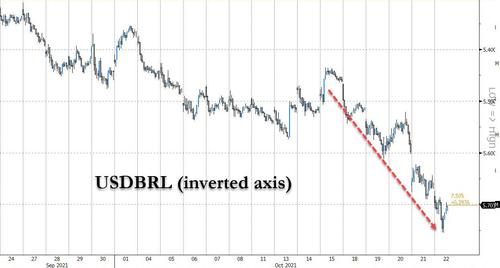

The Brazilian Bovespa index plunged 6% far this week, sending its drop from its June highs to 21%, while the real has is down nearly 10% this week alone.

The reason Brazilian markets are melting down is because after doling out generous public benefits during the early days of the pandemic (just like its far wealthier developed nation peer), Bolsonaro – who was recently accused of “crimes against humanity” by the Brazilian senate – is now pushing to hand out even more benefits to his struggling people, who are (just like in the US) suffering through runaway inflation on top of a lackluster economy battered by COVID, and the trappings of a recession that lasted for years before the pandemic even started.

According to BBG, Bolsonaro’s government is pushing to pass a new social program that Bolsonaro has been advocating as he seeks to boost his flagging popularity – which has fallen to record-low levels – before he faces a race for re-election next year. Bolsonaro’s plan involves using last year’s inflation to adjust public spending limits, instead of the inflation from the latest 12 month period ended in June, as required under current rules. Not surprisingly, the difference between the two rates is quite huge.

In response to what they reportedly see as feckless and dangerous maneuvering by the president, exacerbated by an unwillingness by Bolsonaro’s Finance Minister, Paulo Guedes, four senior economy officials resigned Thursday night, publicly citing personal reasons but privately expressing their fears about Bolsonaro’s fiscal plans, and sparking a surge in selling of the Real. According to Bloomberg, Guedes himself plans to stay on, reportedly because he fears his departure would only make a bad situation worse.

The market’s concern is that while many Brazilians have been hit hard financially by the pandemic – and certainly could benefit from more government handouts – additional spending on that magnitude risks backfiring by deepening a surge in inflation that would only further decelerate the slowing domestic economy.

Amid the battle over more fiscal stimulus, the people running Brazil’s central bank have already been scrambling to get ahead of runaway inflation and bring it back to heel by hiking interest rates this year. Inflation Most expect the Brazilian central bank, led by Roberto Campos Neto, to hike its benchmark rate by by 150 basis points at the upcoming policy meetings next week, with the Selic rate expected to reach 11% by the end of the monetary tightening cycle, as the central bank tries to bring inflation back to its target. Brazil’s inflation rate hit double digits earlier this month, something Brazilians haven’t seen since…2016.

Fortunately for Brazilians, as we have previously noted, there’s a phrase Campos Neto has used many, many times: “we’ll do whatever it takes to tame inflation.”

Partly because of this clash between monetary and fiscal policy, “[n]o one can really tell what’s ahead now. For markets, the move we’ve been seeing for the past few months continues — stocks down, currency down, rates up,” said Mariam Dayoub, chief economist at Grimper Capital. “It’s just gotten worse now, and will only stop when we see something that puts a halt on this fiscal erosion.”

Meanwhile, there is a growing fear that the Brazilian economy could sink into recession by next year.

Gustavo Pessoa, a founding partner at hedge fund manager Legacy Capital, says Brazil’s spending cap is on track to be breached in “the worst possible way,” and that the decision could place Latin America’s largest economy on track to slide back into recession next year. Before COVID hit, Brazil’s economy had only just emerged from a deep recession (note: Legacy recently sold out of its positions in Brazilian fixed income).

As Bolsonaro continues his campaign, and Brazilian assets continue to tumble, we have what to some might seem like a simple solution to this problem. Want to print more money to give to your people? Then just make the real a global reserve currency like the dollar.

Tyler Durden

Fri, 10/22/2021 – 13:14

Continue reading at ZeroHedge.com, Click Here.