Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Hawkish Powell Hits Stocks; Bitcoin Flat As Breakevens, Bond Yields & Bullion Bounce

A very mixed week across the asset-classes.

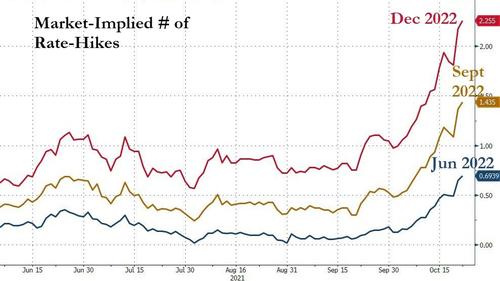

Hawkish Powell: rate-hike expectations surged higher but stocks gained, crude rallied but copper tumbled. Growth and Value stocks basically ended the week up around the same amount (while Cyclicals modestly outperformed Defensives). Perhaps most notably, rates vol and stock vol expectations are dramatically decoupled from one another.

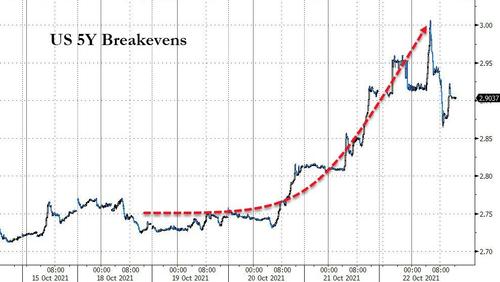

Inflation: Breakevens soared to record highs… globally, bullion bounced but bitcoin ended the week unchanged and bonds only modestly higher in yield.

Source: Bloomberg

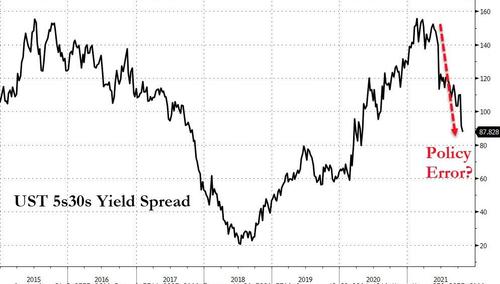

We do not that the long-end of the curve notably outperformed today (flattening the curve significantly) after Powell’s comments, in a clear signal from the market that it’s expecting a Policy error…

Source: Bloomberg

Arguably, as Goldman details below, the market could be morphing back from a ‘stagflation’ narrative to a ‘reflation’ narrative…

Heading into the week, the ‘stagflation’ narrative was continuing despite the fact that the S&P 500 had already bounced off of its late-September bottom and was heading back towards an all-time high. And as we exit the week, the inflation debate seems to be evolving into a ‘the Fed will hike earlier’ narrative, with yields on 2-year Notes spiking to 0.50% — a level last seen in the first days of the pandemic way back on March 18, 2020. Praveen Korapaty writes in last Friday’s note, “Front-end pressures mount,” that markets appear to have returned to a paradigm of simultaneously bringing forward and/or accelerating hike pricing and taking down terminal rate assumptions. Bond investors appear to be increasingly thinking that the rise in inflation that we have been observing will translate into an earlier Fed funds rate hike.

And yields on 10-year Treasuries also briefly touched 1.70% this week, suggesting that bond investors are actually also feeling fine about longer-term growth. And this better feeling is also being reflected in stock prices with the S&P 500 breaking up above 4500 and hitting a new all-time high this week. So, the ‘stagflation’ narrative seems to be morphing back into a ‘reflation’ narrative — something similar to what we were experiencing when the economy first ‘reopened’ last spring.

Digging into each asset class, stocks ended the week higher overall (despite today’s Powell-driven dip that sent Nasdaq down around 1% today)…

The S&P and Dow closed at record weekly closing highs…

In Canada, the S&P/TSX Composite is up 13 straight days to a new record high – the longest winning streak since 1985…

Source: Bloomberg

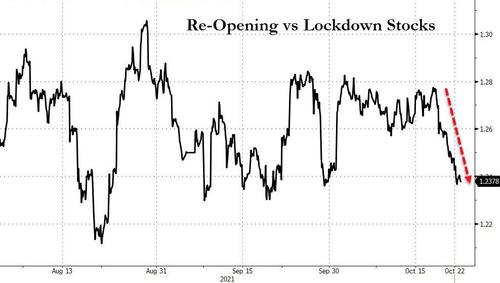

Rather interestingly, this week saw “get out and party” recovery stocks underperform the “stay at home and sulk” stocks…

Source: Bloomberg

Cyclicals modestly outperformed Defensives on the week…

Source: Bloomberg

Growth barely outperformed Value on the week…

Source: Bloomberg

TSLA topped FB in terms of market cap again today (to become the 5th biggest company in the S&P) as Musk’s carmaker surged to new record highs above $900…

Source: Bloomberg

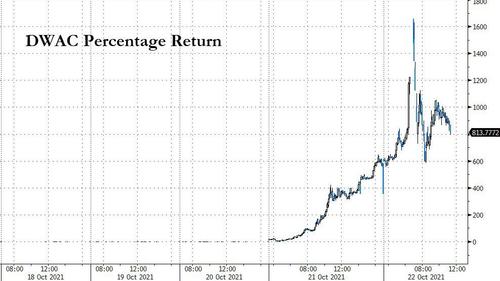

But the week’s biggest gainer was Trump’s “TRUTH” SPAC which ended up over 800% (though at one point it was up over 1600%)…

Source: Bloomberg

VIX traded down to a 14 handle this morning – the lowest since before the pandemic lockdowns began…

Treasury yields ended the week higher, but the long-end notably outperformed…

Source: Bloomberg

The yield curve ended the week notably flatter (after a wild ride midweek back to last week’s highs)…

Source: Bloomberg

Policy Error? The flattening started with the June taper chatter…

Source: Bloomberg

Inflation Breakevens soared to record highs today (US 5Y topped 3.0%) across the globe today…

Source: Bloomberg

The dollar ended the week lower, chopping around at one-month-lows…

Source: Bloomberg

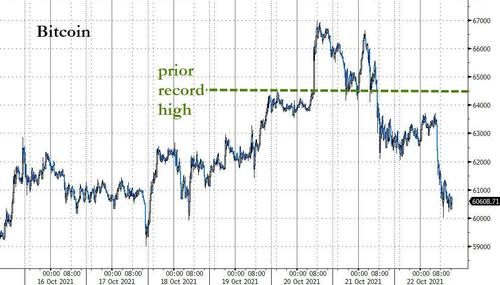

Cryptos had a wild ride for the week with Bitcoin reaching new record highs after BITO’s launch before fading back to unchanged on the week today (Ethereum modestly outperformed on the week)…

Source: Bloomberg

Bitcoin ended the week just above $60k, well off the $67k record high…

Source: Bloomberg

The newly launched Bitcoin (futures) ETF (BITO) ended below its opening level…

Bitcoin Futures were well bid as BITO launched but the premium over spot has faded since…

Source: Bloomberg

Commodities were very mixed with copper clubbed and silver soaring (gold and crude also rallied)…

Source: Bloomberg

Rather interestingly, the huge divergence between copper and silver occurred at a key resistance level (around 20 ounces of silver to buy copper)

Source: Bloomberg

Finally, we note Mizuho’s warning of the impact of today’s more hawkish speech from Fed chair Powell. Our view that the divergence of equity implied vol (at pre-pandemic lows) from rates implied vol (rising to the highs of the year in most markets) is unsustainable, is showing tentative signs of turning.

Source: Bloomberg

The sharp move lower in Nasdaq futures and widening of CDS indices is a warning shot, we feel, of how risk assets would break down if the Fed was to try to stamp out inflation at such an early point in the cycle as mid 2022.

Commodities relative to stocks are starting to flash some red alerts…

Regime Change

The recent commodity outperformance vs. the Nasdaq (9% in 8 days) is one of the most significant stretches in twelve years. On par with readings in 2008 and the dot-com bubble. pic.twitter.com/nNm1rUsuNT

— The Bear Traps Report (@BearTrapsReport) October 5, 2021

And if one needed an excuse to buy some protection against that whiplash reality check for stocks, VIX is at a critically cheap level relative to VXV…

Source: Bloomberg

That has not tended to end well for stocks.

Tyler Durden

Fri, 10/22/2021 – 16:01

Continue reading at ZeroHedge.com, Click Here.