Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Stocks Stink As Curve Pancakes On Stagflation Fears

It was another choppy day in the market which saw an overnight attempt to recover from losses get sabotaged at the open when a sell program knocked spoos lower and the result was a rangebound, directionless grind for the rest of the day as the continued pressure of negative gamma prevented a move higher, and since they couldn’t rise, stocks sold off closing near session lows.

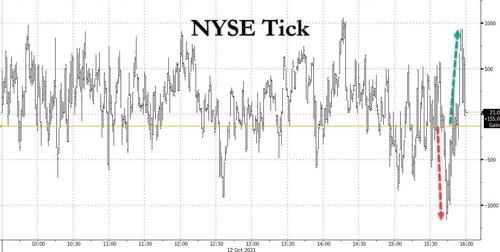

Granted, there was the usual chaos in the last 30 minutes of trading, when a huge sell program was followed by an almost identical buy program…

… but it was too little too late to save stocks from another down day.

While the Russell, energy stocks and banks managed to bounce and drifted in the green for much of the day – perhaps as investors looked forward to good news from JPMorgan tomorrow when the largest US bank kicks off earnings season – the rest of the market did poorly with most other sectors in the red.

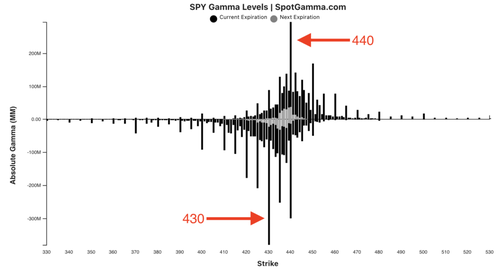

Earlier today we noted that the SPY remains anchored by two massive gamma levels, 430 on the downside and 440 on the upside…

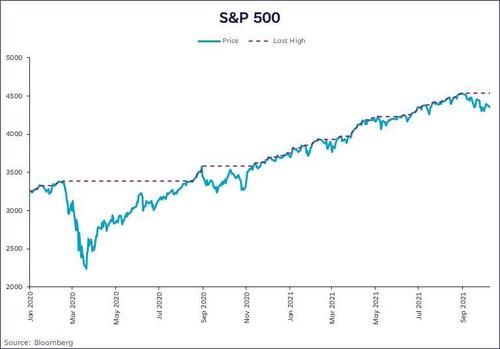

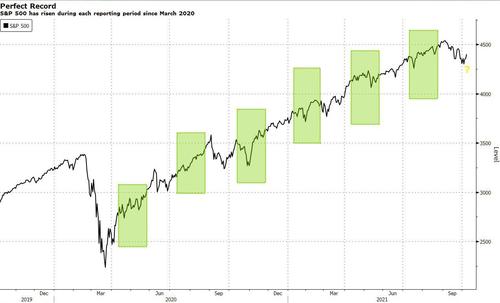

… however that may soon change. As SoFi strategist Liz Young pointed out, “It’s been 27 trading days since we hit a new high on the S&P 500. The last time we went this long was…exactly this time last year. New highs happened on Sept 2nd, both years, before a pause.”

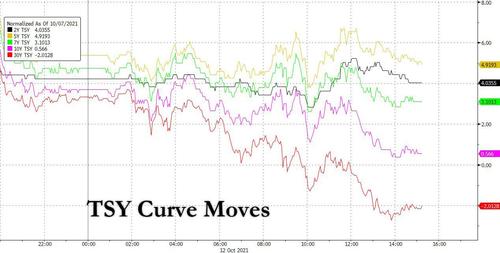

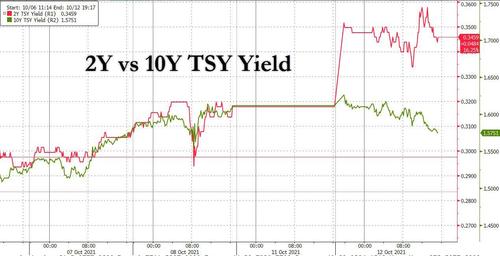

In rates we saw a sharp flattening with another harrowing CPI print on deck tomorrow which many expect to roundly beat expectations…

… with the short end rising by 3bps, a move that was aided by a poor 3Y auction which saw a slump in the bid to cover and a plunge in Indirect takedown, while the long end tightened notably, and 10Y yields on pace to close 4bps lower.

The dollar went nowhere, and while oil tried an early break out and Brent briefly topped $84, the resistance proved too much for now and the black gold settled down 31 cents for the day at 83.34 although WTI did close up 4 cents, and above $80 again, at $80.54 to be precise. Still, with commodity prices on a tear, it’s just a matter of day before Brent’s $86 high from October 2018 is taken out.

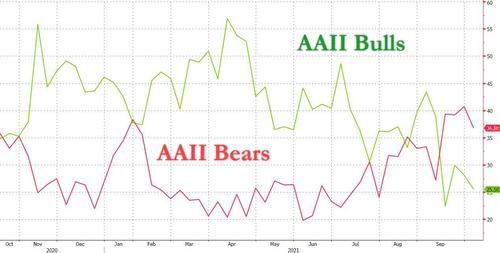

With stocks failing to make a new high in over a month, investor sentiment has predictably soured with AAII Bulls down to the second lowest of 2021, while Bearish sentiment continues to rise.

There is another reason sentiment has been in the doldrums: traders are concerned that price pressures and supply-chain snarls will drain corporate profits and growth, and expect disappointment from the coming earnings season which according to Wall Street banks will be a far more subdued affair compared to the euphoria observed in Q1 and Q2. Quarterly guidance, which improved in the runup to the past four reporting periods, is now deteriorating, with analysts projecting profits at S&P 500 firms will climb just 28% Y/Y to $49 a share. That’s down from an eye-popping clip of 94% in the previous quarter.

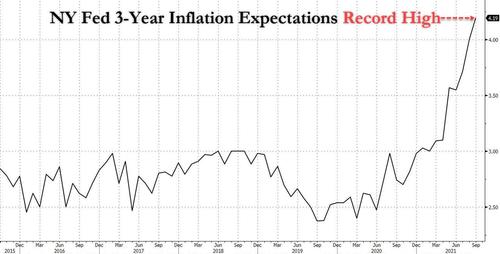

Meanwhile, adding to the downbeat mood, Atlanta Fed President Raphael Bostic finally admitted that inflation is not transitory, and the Fed should proceed with a November taper amid growing fears that inflation expectations could get unanchored. Earlier in the day was saw that 3Y consumer inflation expectations hit a record high 4.3% confirming that the Fed is on the verge of losing control.

Vice Chair Richard Clarida agreed and said that conditions required to begin tapering the bond-buying program have “all but been met.”

Finally, the IMF delivered more bad news today when it cut its global GDP forecast while warning that inflation could spike, and cautioned about a risk of sudden and steep declines in global equity prices and home values if global central banks rapidly withdraw the support they’ve provided during the pandemic. In short, the world remains trapped in a fake market of the Fed’s own creation.

Tyler Durden

Tue, 10/12/2021 – 16:02

Continue reading at ZeroHedge.com, Click Here.