Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Crushingly Boring Session Ends With Spoos Failing To Hold 4400

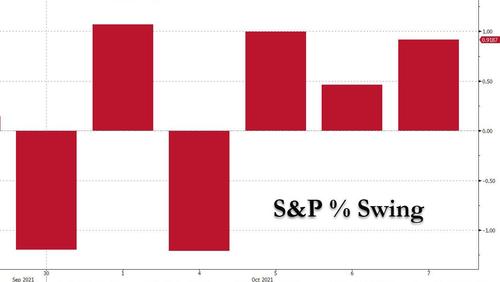

Following several days of nerve-racking rollercoaster moves in the market, which included 1% swings on 4 of the past 5 days, today’s action – which also culminated with another 1% up day – was crushingly boring…

… as stocks ramped early following news that a debt ceiling disaster has been averted delayed until December, and which pushed all sectors solidly in the green..

… with the Dow scrambling – and failing – to stay above the 50 DMA…

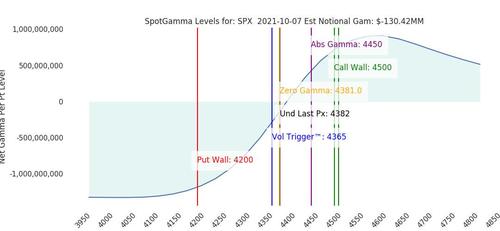

… while spoos even more valiantly tried to defend the critical gamma level of 4,400 following a slow drift lower in the slow afternoon session…

… and also failing.

As a reminder, SpotGamma noted this morning is key for what the market does next as “any additional decline in implied volatility offers a smaller market tailwind, and if we shift over 4400 that tailwind will transition to headwind.”

In other words, the rollercoaster must go on.

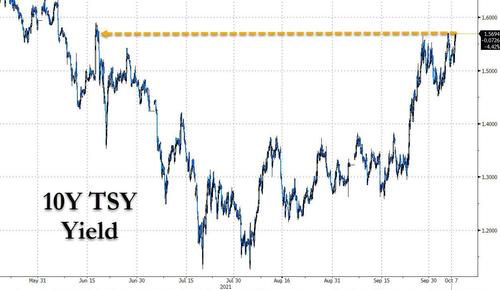

Meanwhile, in a repeat of Tuesday’s action, today’s ramp took place even as yields surged with the 10Y rising above 1.57%, the highest level since June…

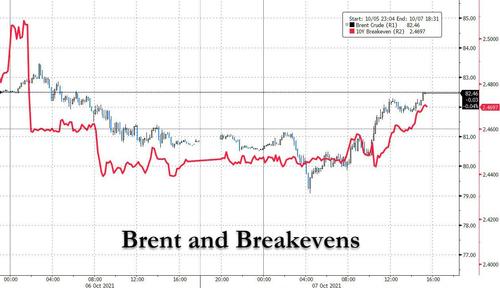

… only unlike earlier this week, it was the combination of both real rates and breakevens that pushed nominals higher, and while BEs started off on the back foot earlier, they promptly spiked after brent shot up following a statement from the Dept of Energy that the US would not be releasing any SPR oil, contrary to yesterday’s attempts by the Biden admin to jawbone oil lower.

And while the market was quick to forget all about Europe’s energy crisis after a bunch of media outlets yesterday misinterpreted what Putin said (yes, he will give Europe more gas, yes it will require the Nord Stream 2 to be operational, and no, it probably won’t happen in time fr winter), some grasped that it’s about to get much worse, and after tumbling overnight, UK gas futures were better bid all day.

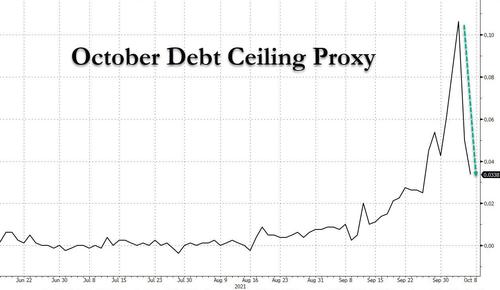

Meanwhile, in what was perhaps the most notable move in the market, bills maturing in mid-October normalized as the threat of a default faded …

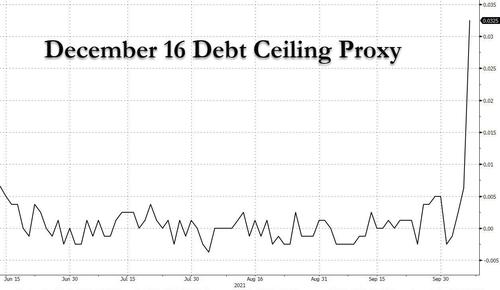

…. only to shift forward two months to mid December, where bond traders now expect the next Drop Dead Date to take place.

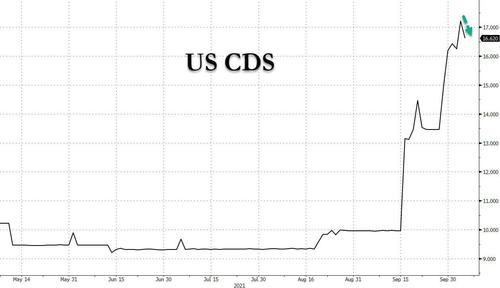

Indeed, as the chart of US CDS shows, despite dipping modestly, the risk of a default remains quite elevated compared to the past year.

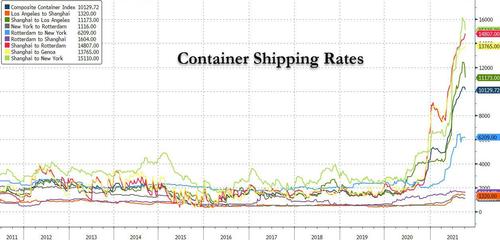

And one final note: containership rates posted their first solid decline today after months of rising…

… only this was not the result of any improvement in supply chain blockages but simply because China suddenly has far less to ship out with much of its producing capacity suffering from brownouts.

Bottom line: nothing has been resolved, the supply chain issues are getting worse, the debt ceiling issue has been punted but hardly addressed, and the S&P closed below its critical gamma level meaning the daily 1% swings will go on…

Tyler Durden

Thu, 10/07/2021 – 16:07

Continue reading at ZeroHedge.com, Click Here.