Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Hedge Fund CIO: China’s Attempt To Crush Digital Assets Has Backfired Spectacularly

By Michael Every, CIO of One River Asset Management

“Is it your intention to ban or limit the use of cryptocurrencies, like we’re seeing in China?” asked Ted Budd, Republican congressman from North Carolina. “No,” replied Fed Chairman Jay Powell. “No intention to ban them?” asked Budd again. “No intention to ban them, but stablecoins are like money market funds, they’re like bank deposits; they’re to some extent outside the regulatory perimeter, and it’s appropriate that they be regulated,” answered Powell. And as it sunk in that the world’s largest economy would not chase China to stifle private sector innovation in the field of blockchain technology, digital assets prices surged

Getting Real

The US dollar is the world’s reserve currency. 59.2% of all official foreign exchange reserves are held as US dollars. 20.5% are euros. 5.8% are Japanese yen. 4.8% are British pounds sterling. 2.6% are Chinese renminbi — slightly more than the 2.2% of reserves held in Canadian dollars. 1.8% are Australian dollars. The remaining few percent are various other small currencies that don’t matter in the grand scheme of things. Swiss francs would be an example. Some reserves are held in gold. Someday, there will be digital asset reserves too.

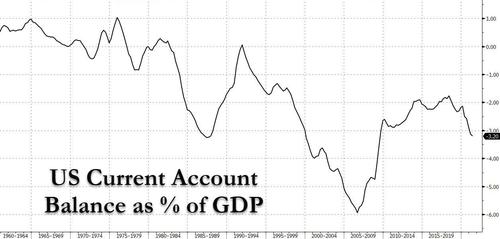

For a foreign nation to hold dollars in reserve, it must first acquire them. It can either purchase those dollars in foreign exchange markets, or it can acquire the dollars by selling its goods, services, hard assets, or financial assets. There are consequences to such transactions. One of them is that the dollar’s value relative to other currencies is higher than it would be if these nations were not buying and holding dollars in reserve. Another is that by acquiring so many dollars and holding them in reserve, the US is forced to run a current account deficit.

When the US runs large deficits, it consumes more than it produces, buying goods/services/assets from foreign nations. This supports economic growth in those nations, job creation, etc. In a world of ever-expanding globalization, such a dynamic was seen as a benefit by almost everyone. Even Americans who lost their manufacturing jobs to foreigners tolerated this for a while. It fed easy credit and cheap consumer goods. Those on the losing-end of globalization remained subdued. That changed in recent years. And it is manifesting politically.

Were the US dollar to lose its reserve currency status, it would decline relative to other currencies. The US current account deficit would have to shrink. In the extreme, US deficits would turn to surpluses – foreign investors, or the lack thereof in this case, would be imposing austerity on US policy. This would be an unmitigated disaster for nations that have built economies to export products and services – almost every nation in the world. So, would any of these countries want to see that? It’s hard to imagine why they would. And it is easy to imagine these nations would try desperately to avoid such an outcome.

So, if the cost of having the world’s dominant reserve currency includes running large current account deficits, having an overvalued currency, and losing manufacturing jobs, why would any nation want this? It appears no nation really does. The Germans buried their deutschmark by adopting the euro. The Europeans wouldn’t tolerate the cost of having the dominant reserve currency. The Japanese sell the yen whenever it gets too strong. There is only one other nation that has an economy that is big enough to potentially bear the costs required to shoulder the burden of issuing the world’s reserve currency – China.

China has several large problems. It is now ageing. Its working age population is shrinking. And unlike Japan, which became a rich nation before starting its demographic collapse, China is still quite poor. Being poor is rough, growing old is tough, experiencing both simultaneously is brutal. After spending decades building the means of production to supply the world with manufactured goods, it may be difficult for China to convince the world they have the fluidity to accommodate being the world’s reserve currency. The benefits to China are clear – the promise of more consumption with more access to global credit at comparatively low interest rates. But the costs are extraordinary and include a loss of control at a time when China is fixated on exerting its dominion.

* * *

Anecdote

“All streams flow to the sea because it is lower than they,” appeared unexpectedly in Xi’s empty mind, the Lao Tzu quote disturbing his morning meditation. Agitated, he inhaled deeply, pausing momentarily, his lungs full, in search of stillness. “Humility gives it its power,” further penetrated Xi’s thoughts, interrupting the moment. As a child, Xi studied the philosophical teachings of Lao Tzu, committing his ancient wisdom to memory. “If you want to govern the people, you must place yourself below them. And if you want to lead the people, you must learn how to follow them.”

This of course, is the source of Xi’s greatest anxiety. China’s swift rise from utter destitution required the state to dominate the activities of its citizens. “Water is fluid, soft, and yielding. But water will wear away rock, which is rigid and cannot yield,” now leaked into Xi’s mind, his meditation a mess, haunted by Lao Tzu. “As a rule, whatever is fluid, soft, and yielding will overcome whatever is rigid and hard.” As China rises and its centrally controlled bureaucracy flourishes, it grows increasingly brittle. All such structures ultimately do.

“If you are untrusting, people will not trust you.” Lao Tzu’s words gnawing at Xi, his security state tightening its grip on individuals in ways that would’ve made an East German Stasi blush. Beijing’s latest technological vice is its central bank digital currency, which in a nation where the government remains above the rule of law, gives leaders vast new power over its 1.46bln subjects.

Xi had naturally hoped Washington would follow Beijing’s lead, undermining the source of America’s strength – which is to defend the value of the individual over the collective. But now it appeared Washington would do no such thing. The WSJ reported Washington would instead seek to regulate private-sector US dollar stablecoin using existing law. Limiting government dominion in sensible ways. Paving the way for innovation. Xi sighed. “The world belongs to those who let go.”

“Appear weak when you are strong, and strong when you are weak,” whispered Xi to himself, refocusing on Sun Tzu wisdom, pushing Lao Tzu to the far recesses of his rattled mind. Xi recognized the near impossibility of his renminbi overtaking the US dollar, and yet there is value in having so many people believe this is his plan. The world’s nations hold $7.1trln in official US dollar reserves (22.7x the world’s $312bln renminbi held in official reserves). “Know yourself and you will win all battles,” thought Xi, recounting his favorite Sun Tzu quote, as true today as when the general wrote it in 530 BC, penning the Art of War. Xi’s decision to outlaw cryptocurrency trading was a risk he had preferred to avoid. It revealed a great weakness.

When given the opportunity, Chinese citizens sell their renminbi to escape an economic system where his government remains above the rule of law. So, naturally, Xi restricted his subject’s ability to exchange renminbi for dollars. In the digital world, absent political coercion, the free market overwhelmingly chose the US dollar as the ecosystem’s stablecoin with 98% of that market’s $126bln now linked to dollars (representing over $100trln/yr in turnover). A large percentage of trading in US dollar stablecoin originated in China. Xi outlawed this activity too. “The supreme art of war is to subdue the enemy without fighting,” thought Xi, ordering yet more fighter planes to violate Taiwan’s airspace, distracting those who might otherwise see his nation as nearing the apex of its power, the world shifting away from globalization, as China’s working age population enters its inexorable decline.

And now the US will allow digital assets to trade alongside its dollar. For all of America’s obvious weaknesses, it remained sufficiently confident to allow its citizens to choose. “Build your opponent a golden bridge to retreat across,” whispered Xi, beginning to wonder whether his adversaries would someday grant him such a path.

Tyler Durden

Sun, 10/03/2021 – 16:05

Continue reading at ZeroHedge.com, Click Here.