Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Taper Tantrum 2.0?

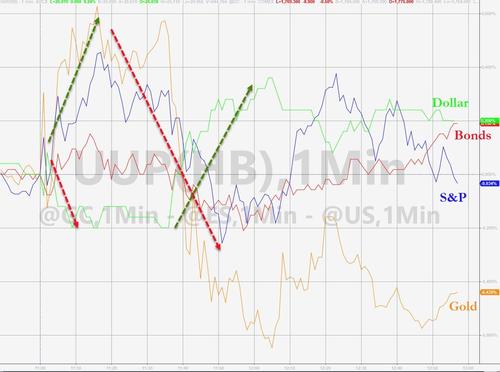

Stocks did what stocks do ahead of The Fed – drifted higher – and then markets all roared higher after The Fed statement (which was undoubtedly hawkish on both the taper and rate liftoff) but it was not until Powell said the taper would be over by mid-2022 that everything reversed (dollar higher; gold, bonds, and stocks lower). But by the close, gold was lower (well why not) and so were stocks while the dollar and bonds held post-FOMC gains…

On a volatility-basis, today was mini-taper-tantrummy, but stocks only cared that Evergrande was ‘saved’ (it wasn’t) and The Fed won’t stop the flow of free money until at least December…Small Caps liftathon all day as short-squeezers were in play

Stocks remain down on the week still however (although Small Caps managed to get green briefly)…

All sectors ended the day green with Energy leading but it was the Evergrande pump open that dominated…

Source: Bloomberg

Treasuries were mixed on the day with the short-end higher in yields (+2bps) and long-end lower (-1.5bps)…

Source: Bloomberg

Th 30Y Yield fell to its lowest since early August…

Source: Bloomberg

10Y Yields ended marginally lower but chopped around in the last few days range…

Source: Bloomberg

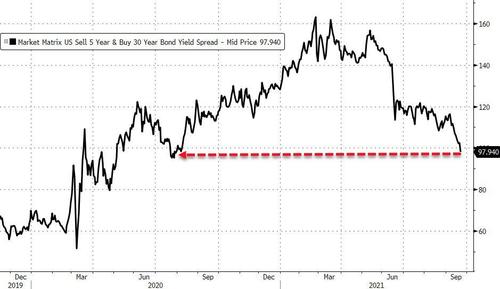

The yield curve flattened dramatically, with 5s30s back at its flattest since June 2020…

Source: Bloomberg

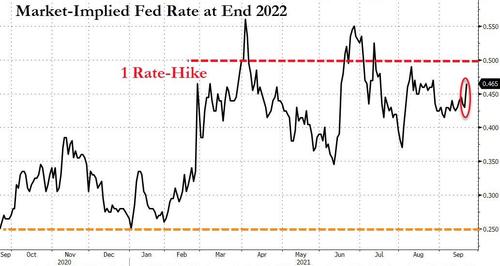

Rate-hike expectations rose modestly on the day – almost entirely pricing in a full rate-hike by the end of 2022 (9 of the 18 members now agree)…

Source: Bloomberg

Before we leave rates-land, it’s worth a look at the anxiety being priced into the short-dated T-Bill market – the market just ain’t buying what the Democrats are selling on any deal getting done…

Source: Bloomberg

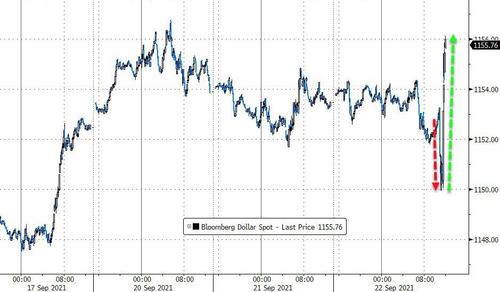

The dollar roller-coastered notably today – lunging down on the FOMC statement then spiking higher on Powell’s taper comments…

Source: Bloomberg

Bitcoin bounced today after two days of bloodbathery. The FOMC prompted and quick pump’n’dump up to $44k…

Source: Bloomberg

Evergrande dominated commodity-land overnight and then The fed dominated this afternoon…

Source: Bloomberg

Gold mirrored the dollar with an initial spike followed by a tumble…

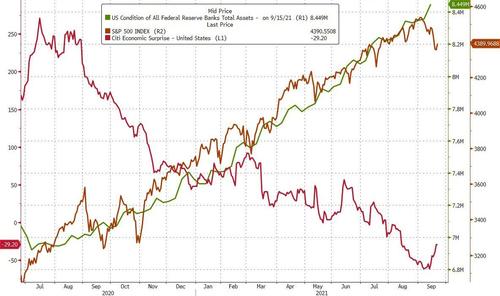

Finally, why does everyone care so much about the Fed’s taper? Simple, stupid! It’s all that matters… it’s the only thing!!!

Source: Bloomberg

How long before the market demands ‘more’?

Tyler Durden

Wed, 09/22/2021 – 16:00

Continue reading at ZeroHedge.com, Click Here.