Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

‘Losing Faith’? – Cryptos & Commodities Rally As Dollar Dumps On Dismal Data, Afghan Angst

An ugly week for ‘hard’ and ‘soft’ data sent the US economic surprise data to its worst velocity since the plunge in March 2020…

Source: Bloomberg

Precious Metals gained as investors’ confidence that the central planners have a clue starts to fade…

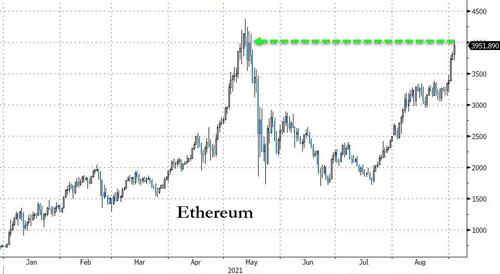

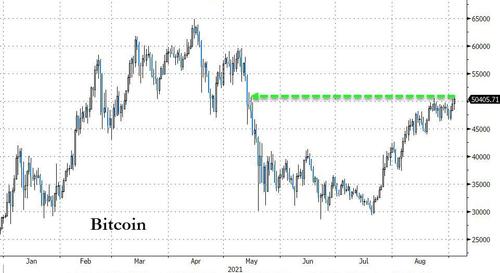

Crypto markets also surged this week as traders sought alternatives to the dollar…

Source: Bloomberg

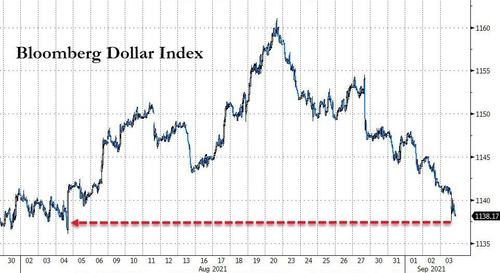

Sending the dollar down to one-month lows, sliding for the 9th of the last 10 days…

Source: Bloomberg

But stocks were mixed with momo-chasers and gamma-hammers always willing to buy any dip. Nasdaq was the week’s outperformer. The Dow lagged the rest of the majors to end the week unchanged…

So stocks are at record highs screaming “all is well” as the dollar, gold, and cryptos all scream “something’s up”…

Value stocks went nowhere as growth dominated (but mostly thanks to Monday’s opening squeeze)…

Source: Bloomberg

An odd week sector-wise with Utes outperforming and Energy & Financials lagging

Source: Bloomberg

Which fits with the dramatic surge in “Defensive” stocks this week with Cyclicals going nowhere…

Source: Bloomberg

VIX trod water on the week, trading in a range between 16 and 17 most of the time…

Treasuries were mixed on the week with the long-end marginally higher in yield and shorter-end marginally lower…

Source: Bloomberg

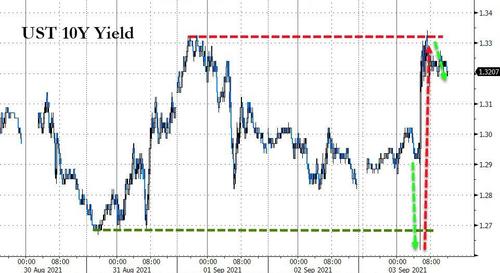

Treasury yields were wild today but a look at the 10Y Yield chart explains some of the movement as the kneejerk lower on the jobs data ran the stops at the low yield of the week and the strong earnings growth sparked a rip higher to run the stops at the high yield of the week…and with the stops run, the liquidty providers left the building for the long weekend…

Source: Bloomberg

Ethereum was the week’s big winner in crypto-land, topping $4000 for the first time since mid-May…

Source: Bloomberg

Bitcoin also had a big week and rose back above $50,000…

Source: Bloomberg

Oil prices rallied on the week, thanks to gains on Thursday largely, with WTI back above $70 intraday but ending back below…

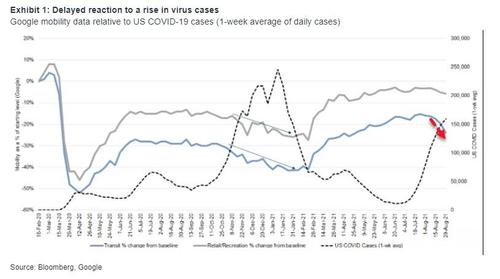

Finally, as we all look forward to a long weekend of socializing, mobility in the US has begun to trend downward again in reaction to the rise in Covid cases — a trend that is likely weighing on Service-sector confidence as we saw in the decline in the Non-manufacturing ISM index today.

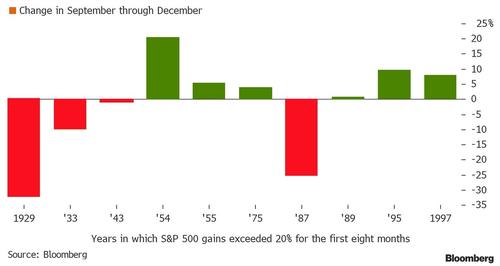

And what happens next in markets? There have been 10 other years in which the S&P 500’s gain through August surpassed 20%, according to data compiled by Bloomberg. The final four months of those years brought everything from a 21% advance to a 32% decline. All this left the S&P 500 with an average loss for the September-December period of 2.1% — and a median gain of 2.2%.

Trade accordingly.

Tyler Durden

Fri, 09/03/2021 – 15:59

Continue reading at ZeroHedge.com, Click Here.