Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Massive Short-Squeeze Erases Yesterday’s Dramatic Stock Losses

During his press conference yesterday, Biden admitted that he chatted to Powell (about The Fed’s “independence”) yesterday. Are we seeing the result of that today?

All major equity indices suddenly exploded higher as the cash market opened with Small Caps the most ridiculous followed by Nasdaq and the S&P, all of which erased yesterday’s losses. Some selling in the last few minutes took the shine off an otherwise perfect squeeze higher, with the S&P falling back into the red from Friday…

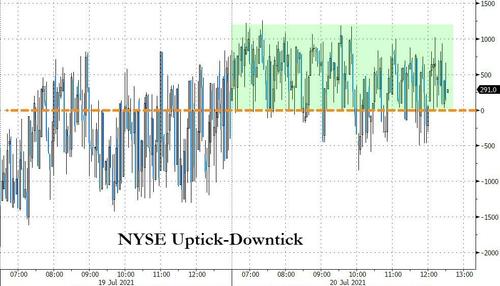

There was barely any net ‘selling’ pressure today… this is one of the wierdest intraday TICK charts we have seen…

Sources: Bloomberg

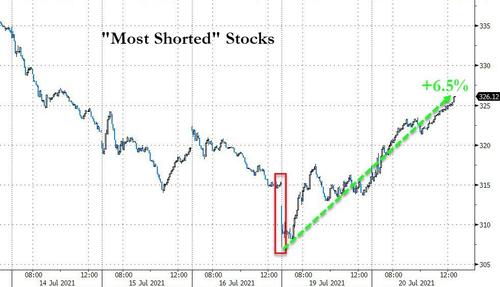

As another massive short squeeze was unleashed…

Sources: Bloomberg

The bounce in the S&P and Dow were extremely technical. The S&P bounced perfectly off its 50DMA…

And The Dow bounced perfectly off its 100DMA, and broke back above its 50DMA…

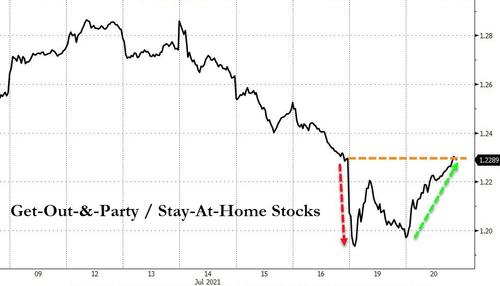

“Get Out & Party” stocks erased all of yesterday’s losses relative to the “stay at home” stocks…

Sources: Bloomberg

VIX plunged back below 20…

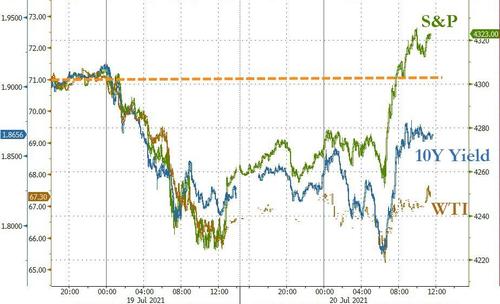

But while stonks soared, bond yields and black gold were not buying it (even though they both rose on the day)…

Sources: Bloomberg

Treasury yields were mixed today with the short-end lower, long-end higher and belly flat, but the day was a notable roller-coaster…NOTE the pattern of buying bonds during Asia/EU and selling during US session repeated…

Sources: Bloomberg

10Y Yields touched 1.12% intraday (lowest since Feb 11th) before bouncing back…

Sources: Bloomberg

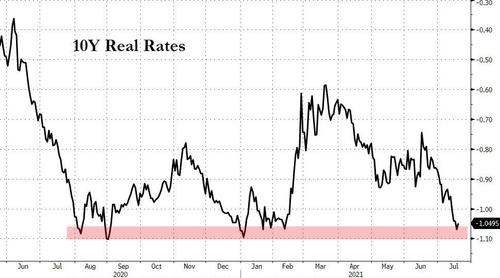

Real rates crashed back to record (negative) lows before rebounding today…

Sources: Bloomberg

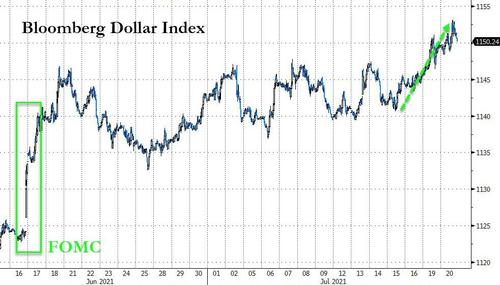

The dollar ended marginally higher on the day after giving back early gains in the afternoon, but made a new post FOMC cycle high…

Sources: Bloomberg

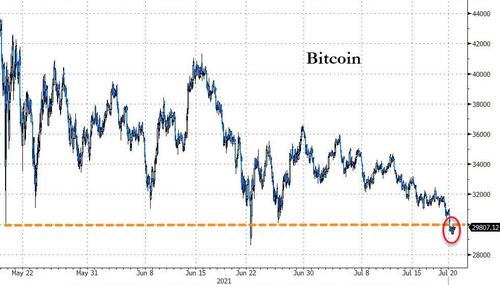

Bitcoin fell back below $30,000…

Sources: Bloomberg

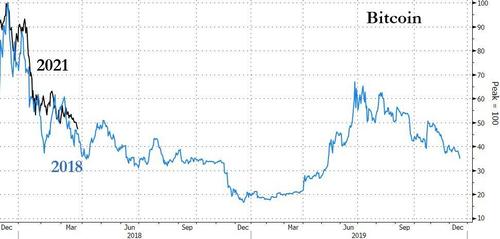

Raising questions about whether this is a 2018 Redux (where $5k was the line in the sand)…

Sources: Bloomberg

Gold and Silver were clubbed like baby seals. Gold managed to hold above $1800…

But silver over the same period is a different picture entirely (back below $25 today)…

And oil’s bounce today was largely unimpressive with WTI unable to regain $68 ahead of tonight API inventory data…

Finally, this is probably just a coincidence, right?

Sources: Bloomberg

Tyler Durden

Tue, 07/20/2021 – 16:00

Continue reading at ZeroHedge.com, Click Here.