Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bitcoin, Black Gold, & The Buck Bounce As England Beat Germany

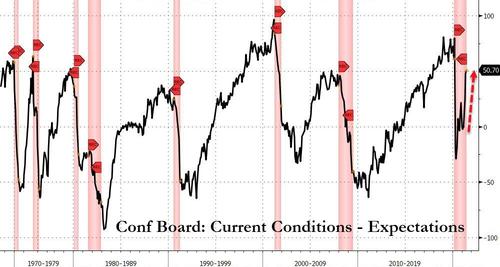

Record surge in home prices (transitory), and Americans’ “hope” is dramatically lagging their current exuberance…which has tended to end badly…

Source: Bloomberg

But this is what really mattered today…

I’m in tears even Bozo Boris was surprised to see Harry Kane score 😂😂 #England pic.twitter.com/Lkp2E3DWwo

— Don 🇫🇷🦁 (@MALISINPARISX5) June 29, 2021

I think that 40,000 crowd at Wembley probably mostly England fans made more noise than a full house pre COVID

The release from the England fans was there for all to see…..most unable to watch their club sides live for 12+ months and then to see England beat Germany at Wembley pic.twitter.com/Z03NhKlGEz

— Dave Foster (@daveandwolves) June 29, 2021

Sorry, had to be done.

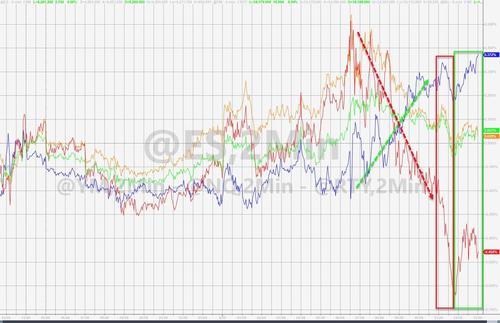

Stocks were quietly going nowhere most of the day with Nasdaq leading but as the England-Germany game ended, stocks sold off. Then in the last hour were bid back leaving Small Caps the biggest loser and Nasdaq leading again. The S&P is up 5 straight days – the longest win streak since March.

S&P and Nasdaq both closed at record highs once again.

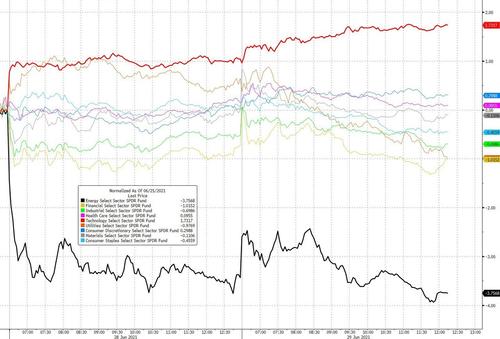

Energy stocks continued to slide (despite some crude gains) and tech continued to rally…

Source: Bloomberg

The rotation back to growth from value extended today…

Source: Bloomberg

Banks were all bid overnight on the buybacks and divi increases but ended down (aside from MS)…BofA, Wells, and Citi are all lower since before the Stress Test results…

Source: Bloomberg

Bonds went nowhere on the day – surprising given the huge Salesforce issuance…

Source: Bloomberg

10Y tested above 1.50% briefly before bid back to unch…

Source: Bloomberg

The dollar extended its recent rebound, but stalled just shy of last week’s highs…

Source: Bloomberg

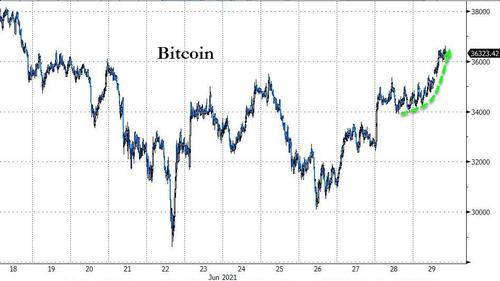

Bitcoin extended its gains today, topping $36k…

Source: Bloomberg

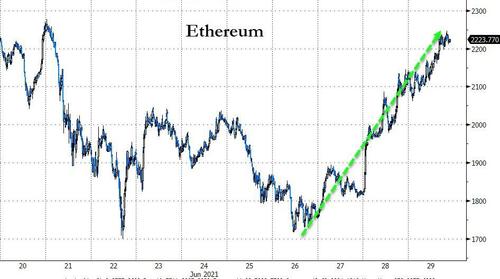

And Ethereum surged above $2200…

Source: Bloomberg

Crude managed gains on the day amid OPEC+ headlines, but copper ended lower along with PMs…

Source: Bloomberg

Gold broke down below last week’s lows and bounced a little…

WTI bounced back above $73 ahead of tonight’s API inventory data…

Finally, as we noted earlier, it has hardly ever been as easy to find a job as it is currently. The spread between consumers who think jobs are plentiful and those that think they’re hard to come by surged to the highest since 2000, according to the Conference Board’s consumer survey. Historically, that only happens at the end of an economic cycle because hot labor markets typically prompt the Fed to tighten.

Source: Bloomberg

Time to start tapering Mr.Powell?

Tyler Durden

Tue, 06/29/2021 – 16:01

Continue reading at ZeroHedge.com, Click Here.