Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Dow Dumps, Nasdaq Jumps As Bonds & Bitcoin Bounce-Back

After Friday’s last-second chaotic moves in Russell 2000 and 1000 on the rebalance, today was clear: Panic Buy Growth, Sell Value… as bond yields plunged.

Source: Bloomberg

And that meant dump The Dow and Small Caps and BTFD in Nasdaq. S&P ended marginally higher (helped by tech)…

That is a record close for the S&P and Nasdaq

Never mind the chaos under the surface (and the weaker macro data surprises), “all is well”…

Today was the 2nd biggest daily spread between Nasdaq and Small Caps in 4 months, and leaves the pair at a critical support level…

Source: Bloomberg

And pushed the Growth/Value ratio back up to key resistance, after bouncing off key support…

Source: Bloomberg

Nasdaq was helped late on by Facebook as the FTC’s Antitrust case was dismissed, pushing FB to new record highs above $1 trillion market cap (almost exactly half of MSFT)…

Source: Bloomberg

But that was followed very closely by DoJ decision to probe GOOGL’s display ad business…

After Friday’s melt-up in yields, today was that entirely unraveled…

Source: Bloomberg

With 10Y yields back below 1.50% and back below pre-FOMC spike levels…

Source: Bloomberg

The dollar managed small gains on the day but remains in a tight range…

Source: Bloomberg

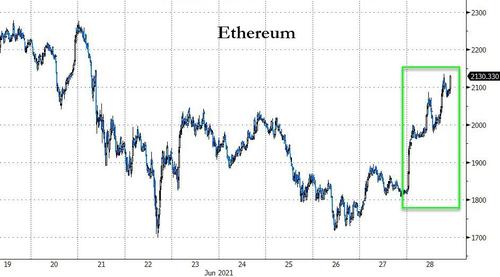

Big bounce back in crypto today after an ugly weekend with Ethereum outperforming Bitcoin by the most in two months…

Source: Bloomberg

Bitcoin managed to get back up to $35k (and traded between 34k and 35k for the day)…

Source: Bloomberg

Ethereum surged up from $1700 to over $2100. Today was ETH’s 2nd best day of 2021…

Source: Bloomberg

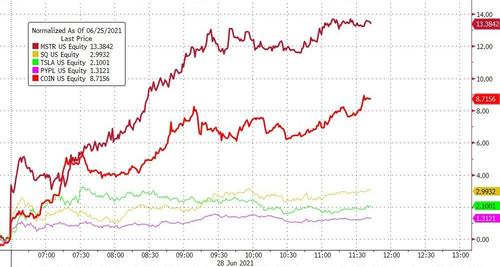

Bitcoin proxy stocks surged today led by MSTR which squeezed dramatically higher…

Source: Bloomberg

Most commodities did very little amid the quiet dollar but crude dropped…

Source: Bloomberg

Lumber continued its collapse, now down 55% from its highs and significantly underwater YTD…

Source: Bloomberg

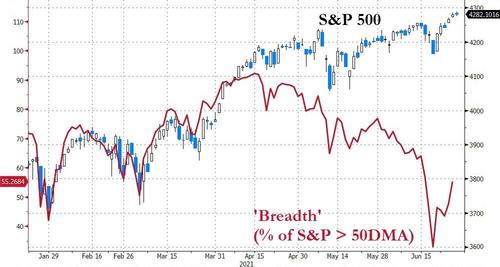

Finally, as Bloomberg points out, the S&P 500’s push to a record hinges on too few constituents. Breadth has been slowly waning since April, to the point where the S&P 500’s record on Thursday came with only 48% of its members trading above a 50-day moving average.

Source: Bloomberg

The last time less than half of the gauge’s constituents hovered above their short-term support line when the index itself notched a record was in December 1999, data compiled by Bloomberg show.

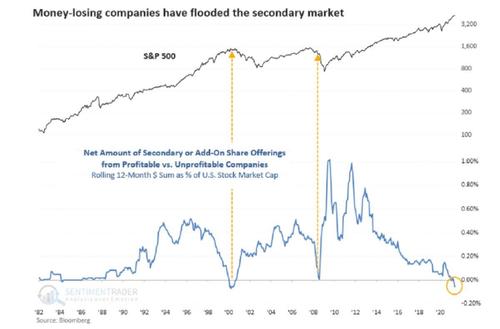

Oh and, as @MichaelaArouet noted, secondary offerings from money losing companies (2000, 2008 and 2021…) but of course this time it’s different…

Tyler Durden

Mon, 06/28/2021 – 16:01

Continue reading at ZeroHedge.com, Click Here.