Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Oil Dumps And Jump After US Lifts Sanctions On One Iranian Oil Official, Clarifies “Nothing To Do” With Nuclear Deal

Update 1230pm: And now oil is rushing back higher, after Bloomberg corrects itself that the US had lifted sanctions on just one Iranian oil official…

- *CORRECT: U.S. LIFTS SANCTIONS ON ONE IRAN OIL OFFICIAL

… while Reuters adds that, as expected, this is just a “routine” change and has “nothing to do with the Iranian nuclear deal talks” at all.

- U.S. OFFICIAL SAYS TREASURY ACTION IS ROUTINE AND HAS NOTHING TO DO WITH IRAN NUCLEAR DEAL TALKS, IS SIMPLY REGULAR DELISTING WHEN FACTS SO DICTATE

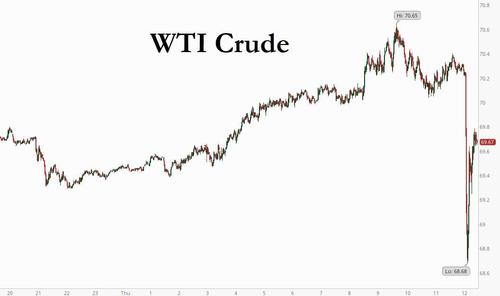

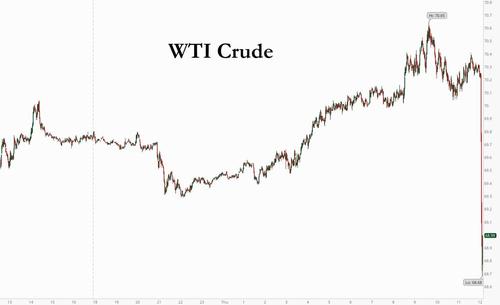

Oil almost back to $70 on the correction. The full statement from the Treasury dept can be found here.

* * *

Oil is tumbling, dropping below the key $70 level, and sliding as low as $68.68 following a Bloomberg report that the US has lifted sanctions on Iranian oil officials as well as entities in Dubai…

*U.S. DELETES SANCTIONS ON 3 PEOPLE, INCLUDING ONE OIL OFFICIAL

… which the market appears to be interpreting as a harbinger of a broader easing in Iranian sanctions, opening the door to more supply from the region.

While there is still little information, the market is likely getting ahead of itself here, because as we reported previously, Iran’s chief negotiator said earlier in Vienna talks that the texts are more transparent, but differences still exist, a sentiment which was underscored by SecState Anthony Blinken who said that “hundreds of sanctions” would remain on Iran even if/when a deal is struck.

Meanwhile, Deputy Secretary of State Sherman said on Wednesday that nuclear negotiations will resume this weekend, adding that a lot of progress has been made in talks but we won’t know if we have an agreement until the last detail is “nailed down.”

As an aside, Iran has said it intends to raise oil output by at least 3.3mln barrels within a month after the lifting of US sanctions, and as much as 4mln BPD within three months. Naturally, should that happen, the oil market will see a surge in new supply but even with millions of new barrels coming online, Goldman last month said that Iran would not have a major impact on the price of oil and wrote that “with growing evidence of the demand rebound, and imminent clarification on the likelihood of an Iranian return, we now see a clearer path for the next leg higher in oil prices, with the sell-off offering opportunities to position for the rally to $80/bbl.”

Tyler Durden

Thu, 06/10/2021 – 12:19

Continue reading at ZeroHedge.com, Click Here.