Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Crypto & Gold Jump As Dollar Dumps, Stocks & Bonds Rise

Aside from a disappointing stagflationary miss on ISM Manufacturing (and Buffett and Munger musings on inflation), the big headlines of today are in crypto where altcoins are screaming higher…

Last time Altcoin Market Cap turned its old 2014 highs into support…

It rallied +27,000% in over a year

Altcoin Market Cap has rallied +119% in 70 days since turning its old 2017 highs into support

This is just the beginning#Crypto #cryptocurrency pic.twitter.com/MKkuDjXKoD

— Rekt Capital (@rektcapital) May 3, 2021

It’s really escalating…

Ethereum has literally exploded to record-er and record-er highs in the last few days, surpassing $3,000 yesterday for the first time and above $3,300 today…

Source: Bloomberg

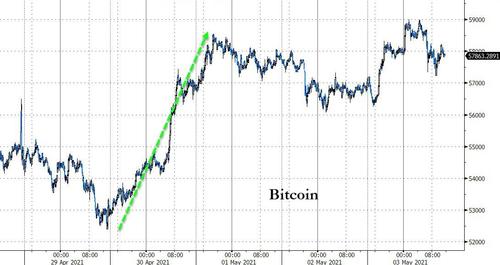

Bitcoin is also on the rise but less so, hovering around $56k…

Source: Bloomberg

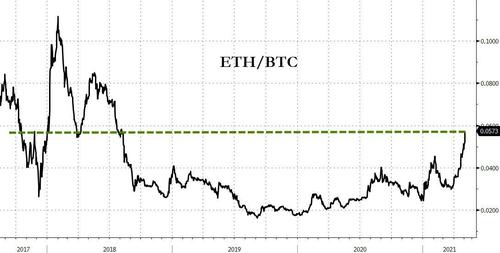

This relative outperformance has sent ETH to its strongest versus BTC since Aug 2018 (the ETH/BTC ratio is at a key historical level here)…

Source: Bloomberg

And as crypto rallies, the dollar resumes its decline…

Source: Bloomberg

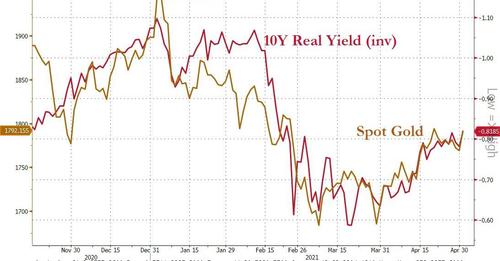

Which has helped send gold prices back near $1800 as the double-bottom below $1700 seems to have held…

Source: Bloomberg

And silver surging up to $27..

Source: Bloomberg

Small Caps and Big Cap Dow stocks were the day’s biggest winners (but well off their highs by the close), S&P managed to hold some gains as Nasdaq lagged notably. The last hour or so saw notable selling pressure…

Energy stocks outperformed, Tech and Cons Disc ended red…

Source: Bloomberg

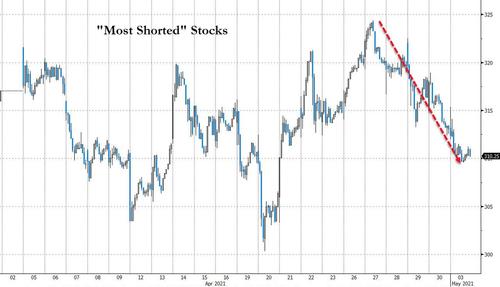

Interestingly, given the Small Cap gains, “Most Shorted” stocks continued their recent slide

Source: Bloomberg

Bonds were bid on the day (after some overnight weakness amid May Day holidays)…

Source: Bloomberg

10Y Yield dropped back below 1.60%…

Source: Bloomberg

Real yields pushed down to their lowest (most negative) since February, helping support gold…

Source: Bloomberg

Commodities continued their charge higher…

Source: Bloomberg

WTI pushed back above $64…

Finally, we’re gonna need a bigger global central bank balance sheet…

Source: Bloomberg

Tyler Durden

Mon, 05/03/2021 – 16:01

Continue reading at ZeroHedge.com, Click Here.