Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Cryptos Crushed, Dollar Dumped, Semis Slammed As VIX Spikes

Bitcoin, the buck, bonds, big-tech (and small caps) were all sold today amid a vacuum of economic data, COVID uncertainties, and “infrastructure” bill size negotiations. It seems investors just didn’t like Monday…

Small Caps were the worst performer today (and the cash open sparked chaos in that index). The Dow was the least worst of the majors with Nasdaq lagging just behind Small Caps…

Small Caps broke back down below its 50DMA…

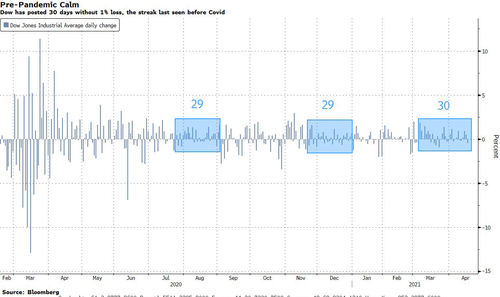

The Dow has not had a down-1% day in the last 30 sessions…

Source: Bloomberg

Seems like a pattern is emerging…

Source: Bloomberg

Algos were unable to ignite any momentum today through a short-squeeze…

Source: Bloomberg

VIX spiked from 16 to 18.5 today…

Credit markets tracked VIX wider in spreads…

Source: Bloomberg

Altria plunged on headlines about the Biden admin cracking down on nicotine…

Semi stocks slumped today – biggest daily drop in a month…

TSLA tanked today after the deadly Texas crash…

And ARKK fell with it…

COIN was down again today…

And the Bitcoin proxy stocks also extended recent weakness (MSTR is now down 25% since thew COIN listing)…

Source: Bloomberg

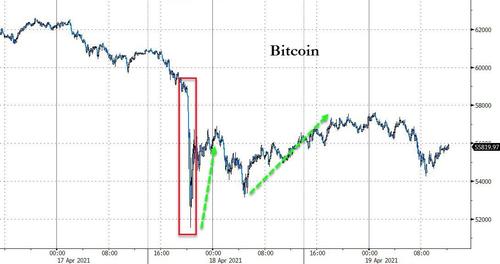

Crypto was clubbed like a baby seal over the weekend, tumbling 20-25% on unfounded rumors of US crackdown before bouncing back on headlines from China appearing to ease their crackdown…

Source: Bloomberg

Bitcoin puked from over $62k to below $52k (with the big plunge from $59k to $52k on Sunday evening) before bouncing back…

Source: Bloomberg

Bonds were bid during the Asia session, dumped during Europe and relatively bid in the US session early on (30Y +2.5bps, 2Y unch)…

Source: Bloomberg

10Y yields were marginally higher but we note that the early spike stalled at Thursday’s ledge…

Source: Bloomberg

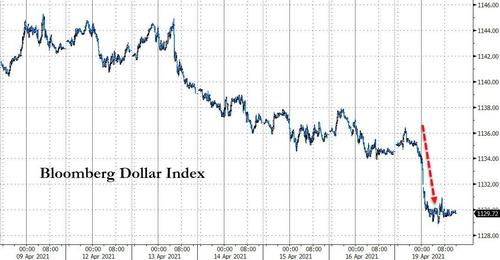

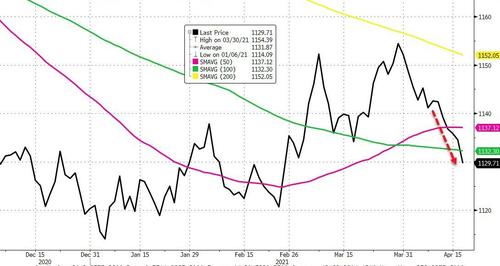

The dollar index resumed its weakness today…

Source: Bloomberg

Breaking below its 100DMA…

Source: Bloomberg

Despite the dollar weakness, gold gave back its overnight gains and then some…

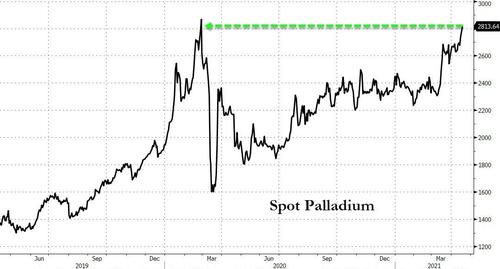

Palladium surged back near record highs…

Source: Bloomberg

“A series of positive supply and demand factors have been driving up prices,” said Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd.

“That at the margin will also have sucked in some speculative trend-following money.”

WTI managed gains today, pushing back above $63…

Finally, we note that the S&P 500 is now 15% above its 200DMA, a level that in the past has marked a turning point…

Source: Bloomberg

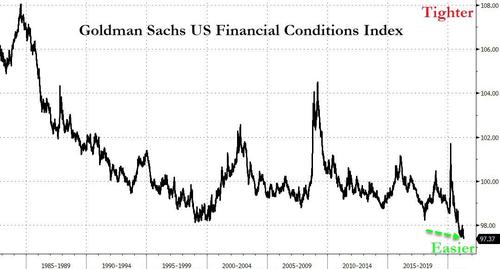

And hey, Financial Conditions are officially at their easiest level in US history…

Source: Bloomberg

…what could go wrong?!

Tyler Durden

Mon, 04/19/2021 – 16:03

Continue reading at ZeroHedge.com, Click Here.