Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

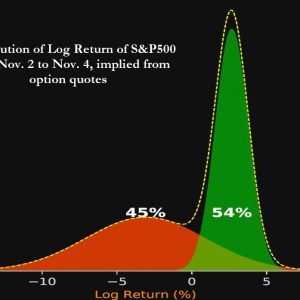

Here’s What Stocks Will Do After The Election According To Options Traders

Tyler Durden

Mon, 11/02/2020 – 15:15

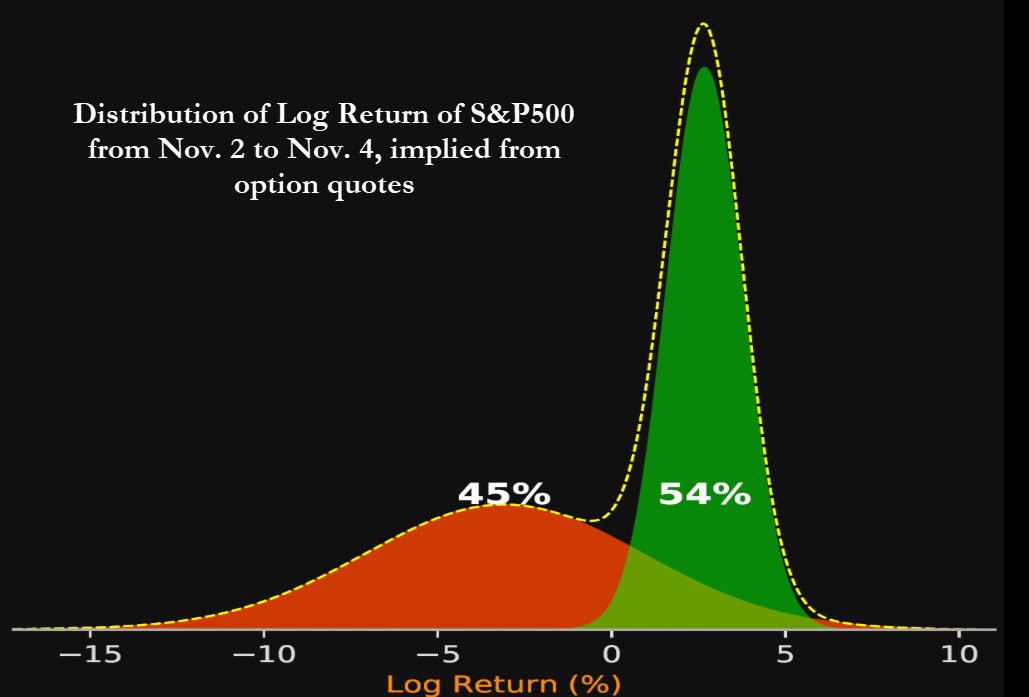

According to a study by Bloomberg’s quants Lily Gu and Bryan Liang, who looked at how options markets are positioned for the election, the market is split in two in terms of what it expects will happen on Nov 4: as shown in the chart below, the equity options market showed a 54% chance of a upside movement (+2.7%) between Nov. 2 and Nov. 4, and 45% chance of a larger drop (-3%).

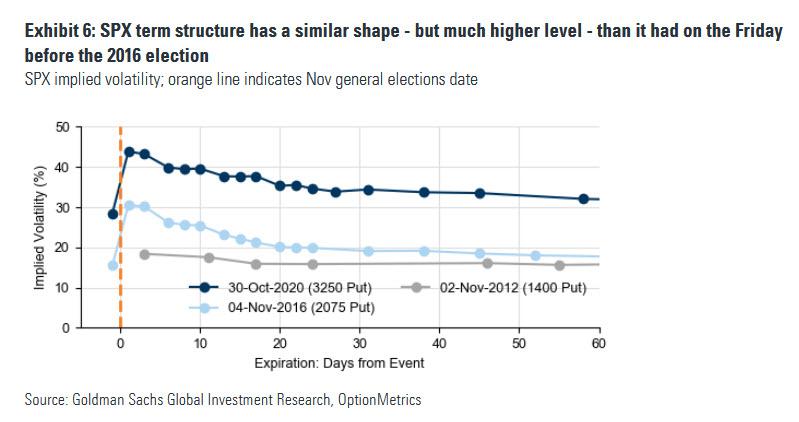

Looking at the option market in general as the next chart from Goldman shows, traders seem to be far more on edge today than the day before the 2016 election: while the SPX term structure has a similar shape, it has a much higher level than it had on the Friday before the 2016 election:

Some other findings from the Bloomberg analysis, as summarized by Bloomberg’s Ye Xie:

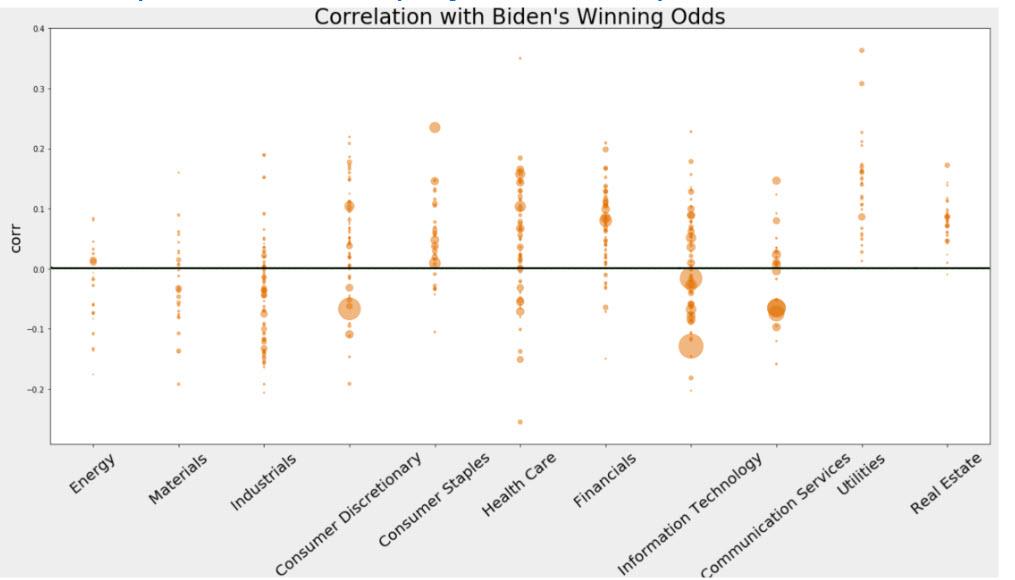

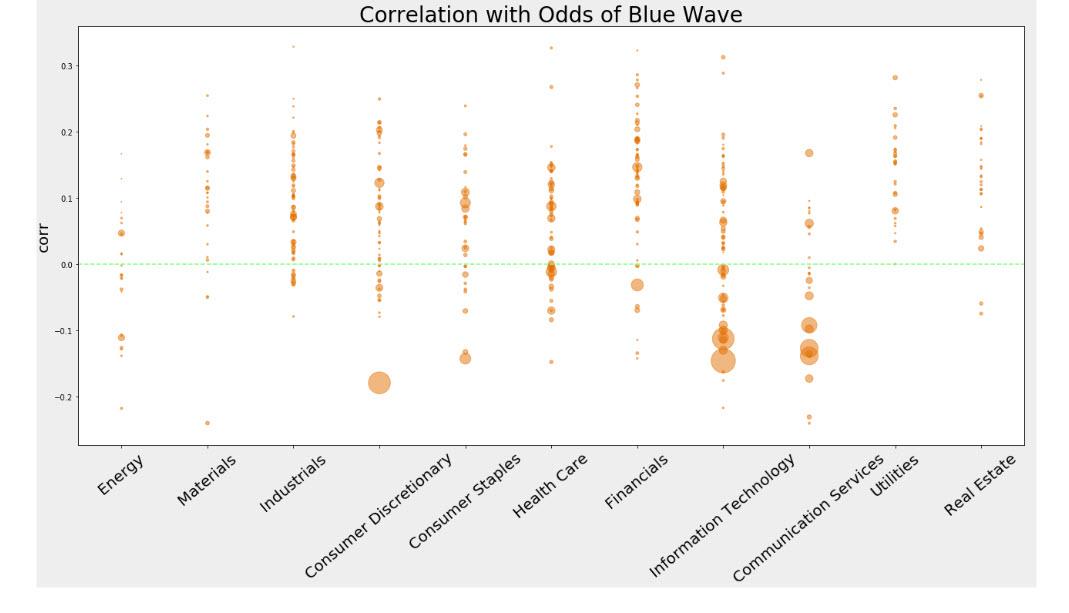

- Utilities and real estate are the most positively correlated to with Biden’s winning odds implied in the betting market, while mega tech companies are negatively correlated with Blue Wave odds, as a Dem sweep would likely result in a burst in reflation trades.

- Most sectors are more positively correlated with the combined odds of the Democrats taking over both the White House and Senate, rather than just a Biden victory.

In other words, “Markets seem to be expecting that a blue wave, which may bring about a largest spending package, is risk positive, at least initially.“

Continue reading at ZeroHedge.com, Click Here.