Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

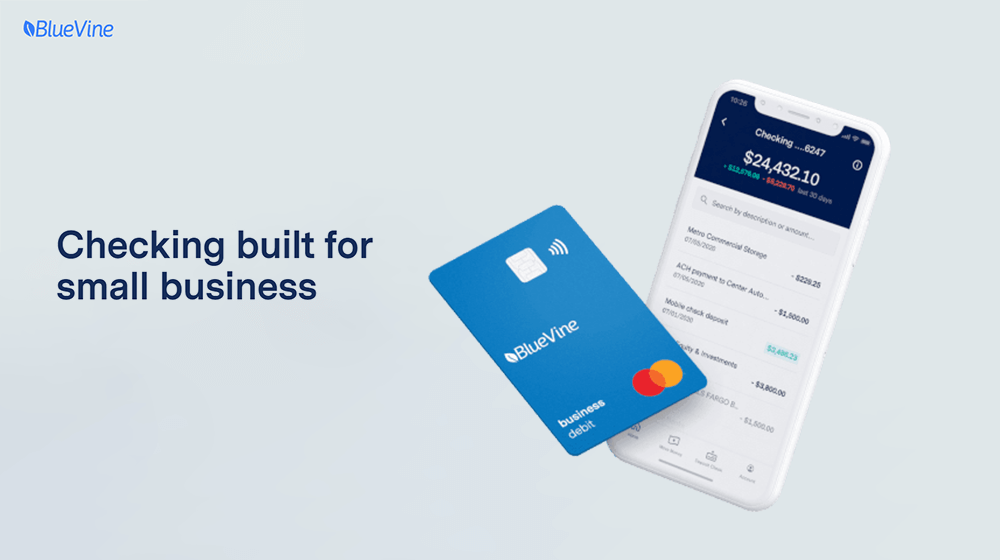

BlueVine Business Banking Available to Small Businesses

The banking industry’s first integrated banking, payments and lending solution for small businesses has been announced by BlueVine Business Banking.

The new product has been designed specifically for small business owners to integrate all their banking needs in one product. The solution enables owners to focus on growing their business instead of the usual fragmented and fee-laden banking experience.

BlueVine Banking for Small Businesses

The benefits of the BlueVine Business Banking product for small businesses include 1.0% interest. This covers all balances up to $100,000, which is twenty times the national average.

BlueVine Business Checking is also listed as a supported bank account to all third-party application and banking partners. This is possible by integrating with Plaid through Plaid Exchange. BlueVine customers can also choose to connect their external bank account in the BlueVine dashboard via Plaid integration.

Other benefits of BlueVine Business Checking include two free checkbooks and zero monthly, ATM, NSF or incoming wire fees. Small business owners also benefit from unlimited transactions with no balance requirements.

BlueVine Payments Feature

An interesting part of the BlueVine Business Banking product is the enhanced bill pay feature called BlueVine Payments. It allows small business owners to pay virtually any vendors or bills by bank account, debit card or credit card. This includes the likes of leases, utilities, contractors and more.

The small business owner simply makes the payment via their preferred means through BlueVine Payments. BlueVine then send the payment to the appropriate vendor either via ACH, wire or check.

Small Business Owners Embrace BlueVine Business Banking

Over 14,000 small business owners have signed up for a BlueVine Business Banking account since October 2019. This includes a 15% week-over-week account registration growth since late August 2020. BlueVine Business Checking also gained over $50 million in deposits and processed nearly $40 million in payments and debit transactions.

Account applications are easy which has also helped increase the rapid adoption rate of BlueVine Business Banking. By sharing basic information about themselves and their firm, small businesses can set up an account in about a minute. The type of businesses signing up to BlueVine are also quite varied in maturity and size. The annual revenues of BlueVine Banking customers range between $50,000 and $2 million.

BlueVine also provided $4.5 billion in funding to over 155,000 small businesses between April and August 2020. This funding helped save over 470,000 jobs as part of BlueVine’s historic participation in the Paycheck Protection Program.

Image: bluevine.com

This article, “BlueVine Business Banking Available to Small Businesses” was first published on Small Business Trends