Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Intel Plummets After Data Center Sales, Gross Margin Miss; Cloud Server Orders Slowing

Tyler Durden

Thu, 10/22/2020 – 16:30

Intel just can’t catch a break.

Despite just beating on revenue and EPS (Q3 revenue of $18.3 billion, down -4.6% y/y, vs exp. $18.22 billion; Adjusted EPS $1.11 vs. $1.42 y/y, estimate $1.10), Intel shares are tumbling after hours after the company’s Q3 data center group revenues fell sharply while the adjusted gross margin also declined, both badly missing estimates.

And while Intel praised recent strength in notebook sales, the stock was far more concerned about the warning from CFO George Davis who said that the company sees orders from cloud server ships slowing.

Here is a summary of the company’s Q3 earnings:

- Adjusted gross margin 54.8% vs. 60.4% y/y, estimate 57.1%

- Data Center Group Revenue $5.91 billion, -7.5% y/y, estimate $6.21 billion

- Revenue $18.3 billion, -4.6% y/y, estimate $18.22 billion

- Adjusted EPS $1.11 vs. $1.42 y/y, estimate $1.10

Looking ahead, the company gave a tepid forecast, while while raised from the previous only met the average analyst estimate.

- Sees FY revenue $75.3 billion, saw $75 billion, estimate $75.13 billion

- Sees 4Q revenue about $17.4 billion, estimate $17.35 billion

- Sees FY adjusted EPS $4.90, saw $4.85, estimate $4.83

- Sees 4Q adjusted EPS $1.10, estimate $1.07 (range $1 to $1.18)

The earnings report confirms that Intel remains in the midst of its worst crisis in at least a decade. As Bloomberg notes, the company has been the largest chipmaker for most of the past 30 years by combining the best designs with cutting-edge factories. And while most other U.S. chip companies shut or sold plants and tapped other firms to make the components, Intel held out, arguing that doing both improved each side of its operation and created better semiconductors. That strategy is being questioned now.

Finally, and certainly not helping the bulls, Intel said it would complete its $2.4BN buyback balance when markets stabilize.

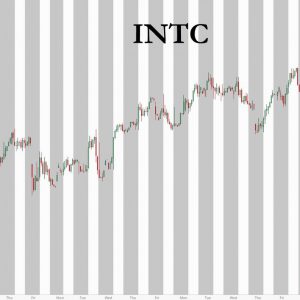

In light of the disappointing earnings, the reaction in the stock was hardly surprising, tumbling 10% to the lowest level in one month, and putting even more pressure on CEO Bob Swan to fix the company’s sprawling problems.

Continue reading at ZeroHedge.com, Click Here.