Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

How to Get Rich (In a Small Business)

A reader wants to know how to get rich in a small business.

“I want to start a small business and hope to become wealthy. Do I need to start a certain type of business? Do I have to give up my personal life? What does it take to get rich?” – Marcus from Coeur d’Alene, Idaho

Rich people come from all types of industries. It’s possible to get rich in an endless variety of businesses.

What’s more, you do not need to be brilliant. You do not have to be a workaholic. You do not need to have some unique talent if you want to get rich, either.

Another common misconception is that you must be in a high-flying industry. There are plenty of rich business owners in ordinary everyday businesses (although you must choose a profitable business – more below).

Here’s the secret most people don’t know.

The most common way to get rich is to be disciplined, make smart money moves and manage your finances well.

That’s it.

Getting rich is about how you live your life and run your business, and what you do with the money you make.

So, back to your question: how do people get rich in a small business? Mostly by adopting good behaviors and money habits in their businesses and personal lives. They have financial discipline. They manage their money well. And that’s something anyone can learn to do.

To get rich take these 10 steps:

1. Start your Day Early

Early birds who start work early before others swear by the productivity and creativity boost. Each day you get a couple of uninterrupted hours before customers and employees start contacting you. You also benefit from extra thinking and planning time.

The more time for concentration, the more you can focus on how to think up new opportunities to get rich from. It’s not about working harder, just smarter. Give yourself uninterrupted time to think, set goals and plan.

If you are a committed night owl, you may be able to get the same benefit — just after hours. It’s the same thing, only in reverse. You are working when others are not. This will help you build wealth.

2. Have the Courage to Take Risks

As a group, entrepreneurs and business owners tend to have a higher threshold for taking risks than the general public.

Pete Warhurst, the founder of PODS, was already in the traditional storage business when he came up with the idea of portable storage units. He says you can’t be afraid of risk – just be calculated.

“You’ve come up with an idea, and your gut and instincts tell you it’s a good idea, be willing to take the risk. But monitor the decisions you make and be willing to admit when you made a bad one and change it and fix it,” he is quoted as saying. He sold the company and eventually it became a billion dollar business.

Nothing ventured, nothing gained. Be prepared to take risks if you want to get rich. But, walk into it with eyes open and protect the downside by managing the risks carefully.

3. Live Below your Means

If you want to get rich and stay rich you have to save and not let your money flow out the door. Many rich people live below their means. Whatever their income is, they spend less than they earn.

Wealthy people love a bargain like the rest of us. For example, one study by Reuters found that millennials enjoy shopping at dollar stores. About 29% of millennials who shopped there earned over $100,000 per year.

If you can accumulate money early, you can invest it and make it grow. Rich business owners:

- Do not live in the biggest house in the neighborhood.

- Do not eat out at expensive restaurants every night – they save it for special occasions.

- Avoid the trappings of an expensive lifestyle (clothes, travel, etc.)

Their neighbors may look wealthy but remember they may not actually be rich because they spend everything they earn. Rich people, by contrast, know that spending like you are rich is not the way to actually get rich. They get rich first. Later when their income is greater they spend.

4. Stick with It; Wealth Accumulates

Slow and steady wins the wealth race. Set goals to accumulate wealth and grow rich, year after year.

A sudden windfall is nice. Who wouldn’t want to win the lottery or get an inheritance? But that’s not how most people become rich.

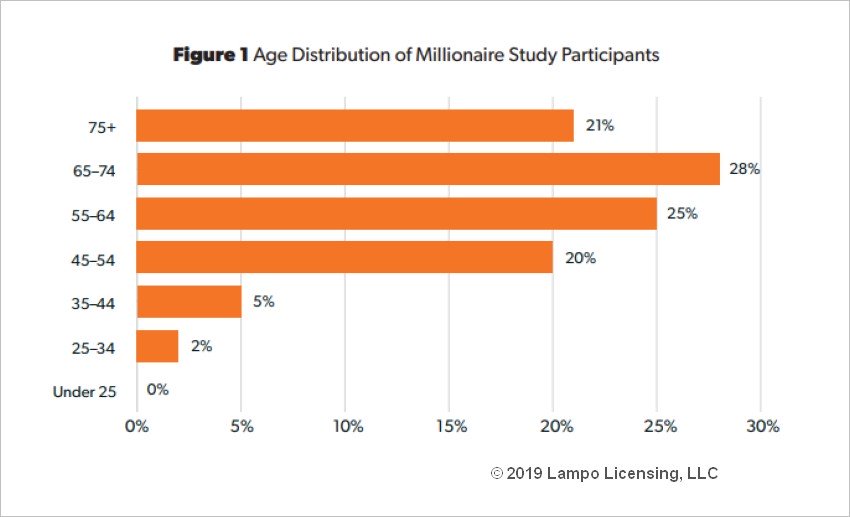

Adopt the right money behaviors, and the passage of time is one factor that helps you get rich. According to one study by Ramsey Solutions, the majority of wealthy people took 28 years to reach a 7-figure net worth. Nearly three fourths of millionaires were aged 55 or older (see chart below).

Time itself helps you become rich.

Young entrepreneurs in your 20s and 30s, take heart. You can be accumulating wealth and on your way to getting rich even if you haven’t achieved that magic 7-figure number yet. Year after year, whatever wealth you accumulate will grow provided you invest it. These days it’s not hard to invest in mutual funds. You can do it online.

5. Pick a Business with Profit Potential

Rich people pick a business with low operating costs and good profit potential. Thousands of different businesses and industries fit this definition.

Avoid businesses with high operating costs unless you are capable of getting outside investment. An example of a business that would take many years to get profitable would be a biomedical startup — because of the lengthy development and regulatory approval process.

Most of us prefer something that throws off profits much faster. Also, to get rich without working yourself ragged, pick a simple business. For ideas of the kinds of businesses that can help you become rich, read: Most Profitable Small Businesses.

6. Run a Tight Ship

In a small business, inefficient operating processes cost money in hidden ways. Sloppiness bleeds profits. Rich small business owners run a tight ship.

Be hands on. Inspect the little things. Broken equipment, lax schedules, cluttered premises — all lead to a general air of carelessness that soon spreads like it is contagious. The flip side is, paying attention to details can transform your business into a lean, mean, profit-generating machine. Details mean the difference between:

- Happy repeat customers (or not!).

- Products and services with such a great reputation that they are easy to sell (versus ones with horrible online reviews).

- Equipment and vehicles that run dependably (instead of constantly breaking down causing missed schedules or extra costs).

Expect everyone in the company to pay attention to details. Create a “tight ship” culture. Lead by example and discuss why details are important. Encourage employees to take pride in working in a well-run business. It will pay off for you and also mentors them in what it takes to run a business to get rich.

7. Become a Frugal Business Owner

Rich business owners are known for being frugal about business spending, not just personal spending. Create a business budget and stick to it. According to one study, a whopping 93% of rich people say they usually stick to budgets they create.

There’s a good test to do before taking on any new business expenditure. Ask yourself, “how many sales do I have to make or how many hours of employee time do I have to pay for, to cover this expense?” When you put it that way, a proposed expenditure many not be essential.

Here are a few practical tips for staying frugal:

Minimize Recurring Charges

Think twice before every new recurring expenditure, even a $20/month bill. Collectively they can add up to hundreds or thousands per month.

Cancel Unused Subscriptions

Many software tools are subscriptions that keep charging every month whether you use them or not. Periodically review recurring charges on credit card statements and your PayPal account for dead weight to get rid of.

Comparison Shop your Existing Vendors

Check around for the best deals on all business services or software tools at least once a year.

Grab the Annual Discount

Switch from monthly payments to annual if you are certain you will use the service or tool. Many vendors offer 10% to 20% off for an annual commitment.

These moves may seem small, but it’s easier to get rich when frugality becomes a daily habit. Also, it has to be more than YOU being a tightwad. Make frugality part of your company culture. Rich business owners train employees, especially managers, to scrutinize every expense.

8. Pay People Well

Best practice is to pay your team the most you can afford, in line with industry pay rates. This may seem to contradict the advice to be frugal, but it is perfectly consistent.

Paying people well reduces hidden expenses like employee turnover, customer-souring bad attitudes, and low productivity due to poor morale. In the long run, it’s less expensive to pay for quality help and reduce churn.

You may get away with paying very low salaries for a while. But when the job market is booming it eventually catches up and you lose your best talent. Treat staff as an asset. They can help build the company wealth and their own wealth at the same time as building yours. It’s a triple win.

9. Collect Receivables Timely

Believe it or not, one of the reasons small business owners do not get rich is that they do not collect their money.

Imagine you and your team work your fingers to the bone, figuratively speaking. Yet all the hard work doesn’t pay off. You are incredibly busy, but end up unprofitable. ‘How did this happen?’ you wonder. The two culprits are:

Failure to Collect

You might be shocked at how many business owners simply fail to send invoices to clients. They don’t have a system and are disorganized. So the owner ends up working for nothing.

Slow Paying Customers

Routinely waiting 60, 90 or even 120 days to get paid wreaks havoc with cash flow, triggering a domino effect. The business could be forced to take out expensive merchant advances, or hit expensive credit cards just to pay the rent. You end up paying extra finance charges.

A key performance indicator that a rich small business owner tracks is Days Sales Outstanding (DSO). This measures the amount of time it takes to collect on invoices. In a well-run company the DSO average is under 30 days. A DSO approaching 60 days or longer signals poorer performance, although average collection times vary by industry.

10. Understand Taxes and Investing

Rich small business owners know that smart tax strategies and financing strategies build wealth. If you want your money to grow, put it to work for you.

Also, learn how to take advantage of tax reduction strategies — legally of course. Take advantage of the top tax deductions for small businesses.

Many wealthy people say that tax-deferred investments like Individual Retirement Accounts or 401(K) plans are instrumental to getting rich. For business owners, you have even more options including Simplified Employee Pension (SEP) and Savings Incentive Match Plan for Employees (SIMPLE) plans.

Learn the value of compound annual growth rates. The power of compound annual growth can turn a modest 401(K) into something much greater over time. Adding regular savings to your investments, such as 10% of your income, also has real power to build wealth. That is what it means to make your money work for you to get rich.

Final Thoughts About How to Get Rich

Most small business owners will never come close to generating the kind of revenues of someone like Facebook founder Mark Zuckerberg. And most of us are just fine with that. You don’t have to be a billionaire to be rich.

Whatever money you earn, follow the example of rich business owners. They treat with respect the money they earn. They know that the way to become rich is to develop habits that give them the ability to accumulate assets and generate more money, year after year.

Images: DepositPhotos, Small Business Trends

This article, “How to Get Rich (In a Small Business)” was first published on Small Business Trends